|

|

|

Are you on holidays in Spain and you want to do a wine purchase, ham purchase, or buy another product in Smartbites to transport it to your country? If you want to do it, you should know all advantages about it because we are a Tax free company. Those people who don´t reside in European Union, they are spending some days in Spain and they want to make a wine purchase to transport it themselves to their country, they have a right to refund the VAT of the purchase made. This way, you can transport your favourite wines and hams to consume at home with a great saving. This Spanish VAT is around 10% in hams and 21% in wines.

Are you on holidays in Spain and you want to do a wine purchase, ham purchase, or buy another product in Smartbites to transport it to your country? If you want to do it, you should know all advantages about it because we are a Tax free company. Those people who don´t reside in European Union, they are spending some days in Spain and they want to make a wine purchase to transport it themselves to their country, they have a right to refund the VAT of the purchase made. This way, you can transport your favourite wines and hams to consume at home with a great saving. This Spanish VAT is around 10% in hams and 21% in wines.

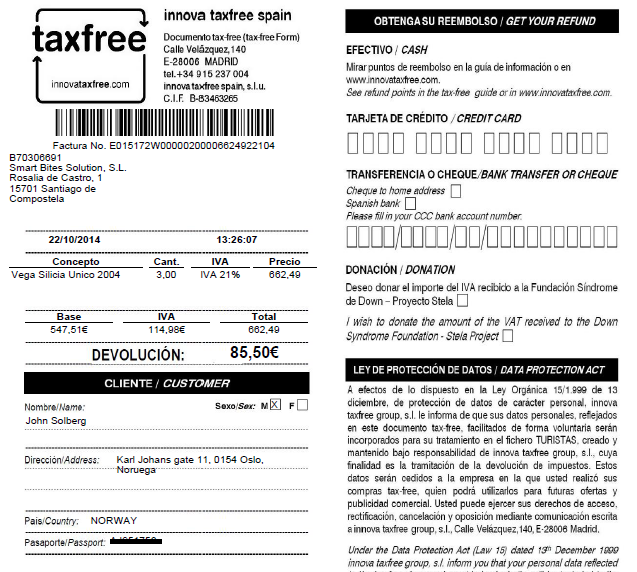

In Smartbites, we can help you to do things easier working in collaboration with Innova Tax Free. For example, when you want to buy our tax free ham, you should apply for the bill and the Tax Free document by a note in the order, or even writing us an email to info@smartbites.net. This way, we will send you a copy like a document you can see at the end of this article(*). With the bill and the document, you can accredit that the purchase of your favourite whisky or cognac have been made in Spain.

|

|

What steps should I follow to refund the VAT of my wine?

|

Once you have received the document, you should follow next steps to get this important discount:

- Keep it saved until you go back to your country. Remember that the validity period to stamp the document shouldn´t exceed 3 months from the moment of purchase.

- Stamp the document in Customs before checking in your luggage, showing the Passport, the bill and all those products if this is necessary.

- Cash your tax free documents by cash or refund into your credit card account at the cash refund desk at major airports and inland border check points. In this link we attach, you can find those places where you can receive the refund of VAT. Places for VAT Refund

On the other hand, you can refund the money by credit card. For this, you should post the document to Innova Tax Free through the freepost envelop provided at the shop.

|

|

Could I refund the VAT in whatever purchase I do in Smartbites?

|

No, you couldn´t. If you want to refund this amount of money, you must meet certain requirements:

- First point and the most important: product has to be allowed in your country. You can ask for information in your Custom.

- The purchase must be higher than 90.15€ (included VAT) and it has to be done at the same shop, in this case in Smartbites.

- You have to accredit the place where you reside through your passport or ID card, verifying this way, you not live in European Union.

- The stamp of the document and the leaving of the country with the product, have to be in a lower period than 3 months since the moment you buy the product in our company.

- This service is not valid for products you buy and consume in European Union. Remember it, you have to transport it yourself to your country.

- Finally, if you are visiting several countries in the European Union, you have to apply VAT refund in the last country you visit before return to your country.

|

|

What countries are in right to a VAT refund?

|

In general, all visitors who don´t live in European Union and they transport the product themselves to their country have right to refund the VAT. To make things easier for you, we offer you a list with the countries where you can claim the refund of VAT:

- Places inside the European Union who YES have the right to refund VAT: The Canary Islands (Spain), Ceuta (Spain), Melilla (Spain), Liviano and Campione Municipalities (Italy), Busingen Heligoland (Germany), Greenland and the Faroe Islands (Denmark), Gibraltar and the Channel Isles (UK), Aland Islands (Finland), Guadeloupe (France), Martinique (France), Reunion (France), St. Pierre & Miquelon and The French Guiana (France), Mount Athos (Greece).

- European countries outside the European Union who YES have the right to refund the VAT: Andorra, The Vatican City, Iceland, Liechtenstein, Monaco, Norway, San Marino, Switzerland, among others...

- European countries inside the European Union who NO haven´t the right to refund the VAT: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the UK.

|

|

How much money will I refund with my purchase?

|

VAT in Spain is around 10% in ham and 21% in wines. When you refund the tax, you never can refund all amount of money. The maximum amount to refund is around 15.70%. In this link you can see the exact amount you can refund depending on value of the purchase you make in our company.

Therefore, if you are on holidays in our country and you want to buy some wine, whisky, cognac, or ham to transport it to your country, like a possible present for your friends or your relatives, not hesitate to claim back the VAT. Also, if you have any questions on the VAT refund procedure, contact us.

(*) Example of tax free document

|

|

|

|

|